European international tax law firms have noted a growing controversy in France on what represents an arm’s length interest rate. A November 2018 presentation by Taxand anticipated this concern:

The French Tax Authorities increasingly focus their attention on intercompany financial transactions. Indeed, the number of tax audits dedicated or focused on financial transactions is reaching its highest. The French Tax Authorities are significantly challenging the benchmarking studies performed by taxpayers so to apply another regulation provided by the French Tax Code, hence an increasing number of tax disputes and litigations in France about this topic.

Other law firms go further and have declared that the French Tax Authority (FTA) often ignores these studies, preferring to go with either a rather low safe haven interest rate or the interest rate paid by the multinational to third-party financial institutions.

While the FTA should respect the arm’s length standard, it is worth noting that many benchmarking studies performed by the representatives of multinationals are not well-reasoned applications of the arm’s length standard. The OECD released its Transfer Pricing Guidance on Financial Transactions on February 11, 2020. This guidance included an extensive discussion of credit ratings that went beyond the choice between the group credit rating versus standalone credit ratings.

A standard model for evaluating whether an intercompany interest rate is arm’s-length can be seen to have two components: the intercompany contract and the credit rating of the related party borrower. Properly articulated intercompany contracts stipulate the:

- Date of the loan;

- Currency of denomination;

- Term of the loan; and

- Interest rate.

The first three items allow the analyst to determine the market interest rate of the corresponding government bond. This intercompany interest rate minus the market interest rate of the corresponding government bond can be seen as the credit spread implied by the intercompany loan contract.

We adopt the Taxand case study to illustrate how sound financial economics enable a more convincing evaluation of the arm’s length standard. This case study suggested an intercompany loan with the following terms:

- Date: January 1, 2018.

- Term: 5-year fixed interest rate.

- Currency of denomination: Euro.

- Interest rate: 7%.

Interest rates on German government bonds at that time were only 0.5% so the intercompany interest rate suggests a credit spread equal to 6.5%. The case study also suggested that the group credit rating was BBB, while the standalone credit rating for the borrowing affiliate was BB. A credible analysis would certainly not support such a high interest rate.

An economic analysis would provide market evidence on how to translate whatever the appropriate credit rating is into a numerical credit spread. While this brief discussion does not present market evidence, the following table illustrates what this evidence would likely show.

Credit Spreads for Various Credit Ratings

| Credit rating | Credit spread | Interest rate |

| A | 1.0% | 1.5% |

| BBB | 1.5% | 2.0% |

| BBB- | 2.0% | 2.5% |

| BB+ | 2.5% | 3.0% |

| BB | 3.0% | 3.5% |

While the 1.5% safe harbor is consistent with a credit rating of A, the BBB group credit rating would support a 1.5% credit spread and an arm’s length interest rate equal to 2%. The appropriate interest rate would likely be between 2% and 3.5% in a French litigation, if the court rejected both the extreme standalone position and the extreme group rating position. The general tone of the OECD guidance and recent court decisions in Australia and Canada suggest an implicit support position, but not the strong implicit support position needed to insist on the group rating standing. If the ultimate credit rating were BBB-, then the arm’s length interest rate would be 2.5%. If the ultimate credit rating were BB+, then the arm’s length interest rate would be 3%.

The Taxand presentation presented a plethora of confusing positions, depending on the nation it discussed. For example:

- Its Italian analysis relied on the BB standalone position and alleged evidence from nine third-party loans to assert a 2.5% interest rate.

- The UK analysis purported to rely on the same evidence to suggest a 3.5% interest rate. The interest rate on 5-year UK government bonds was approximately 1.5% at the time, so this higher estimated interest rate reflects a difference in the currency of denomination.

Taken literally, the Taxand presentation is consistent with credit spreads for borrowers with BBB- credit ratings. Taxand’s Italian analysis included ‘liquidity risk” and “country risk” premiums to inflate the estimated interest rate. Such add-on premiums would likely be rejected by tax authorities.

Taxand’s French analysis appears to justify this very high 7% interest rate, even as the evidence from the Italian analysis suggested a much lower interest rate. The key to this alleged defense of a higher interest rate may be from its “subordination adjustment”.

Chevron Australia Holdings Pty Ltd. v Commissioner of Taxation involved an intercompany loan with a high credit spread that the taxpayer defended with its “orphan theory”. The argument made by the taxpayer went beyond simply the standalone principle as it also included the suggestion that the intercompany loan should be viewed as subordinated debt. The Australian Tax Office (ATO) successfully argued against this premise of subordinated debt and also argued the implicit support position. The ATO argued for a credit rating of BBB even though the US parent’s group rating was AA. In other words, the ATO did not argue for the strong implicit support position leading to the use of the group rating.

While the FTA might insist on the group rating position, recent court cases in other jurisdictions have suggested a more modest application of implicit support. If taxpayer defenses of high interest rates charged to French affiliates rely on concepts such as subordinated debt and other questionable premiums, it is no surprise that the FTA is rejecting such extreme positions.

The international tax law firms are properly warning clients of the audit risk with respect to intercompany financing in France, but are also making this issue unnecessarily complex. A properly prepared analysis would start with the terms of the intercompany loan contract to focus on what its implied credit spread is. While estimating appropriate credit ratings has been controversial, the 2020 OECD guidance is providing clarity around this issue. The key step in any analysis is to provide a reasonable estimate of the credit rating and then translate this letter score into a numerical credit spread.

Potential US Intercompany Loan Controversies

While the IRS tends to respect credible defenses of intercompany loan pricing, developments since the beginning of the pandemic have led to two key changes to market interest rates. One development was the initial spike in observed credit spreads and the other a lowering of government bond rates.

I noted the initial spike in credit spreads in an April 27, 2020 discussion of the market evidence up to that point, which closed with:

Whether this will be only a tidal wave or another tsunami is not yet known. Given the heightened regulatory scrutiny of intercompany financing, multinationals with significant intercompany debt should carefully review whether their intercompany loan agreements are arm’s length.

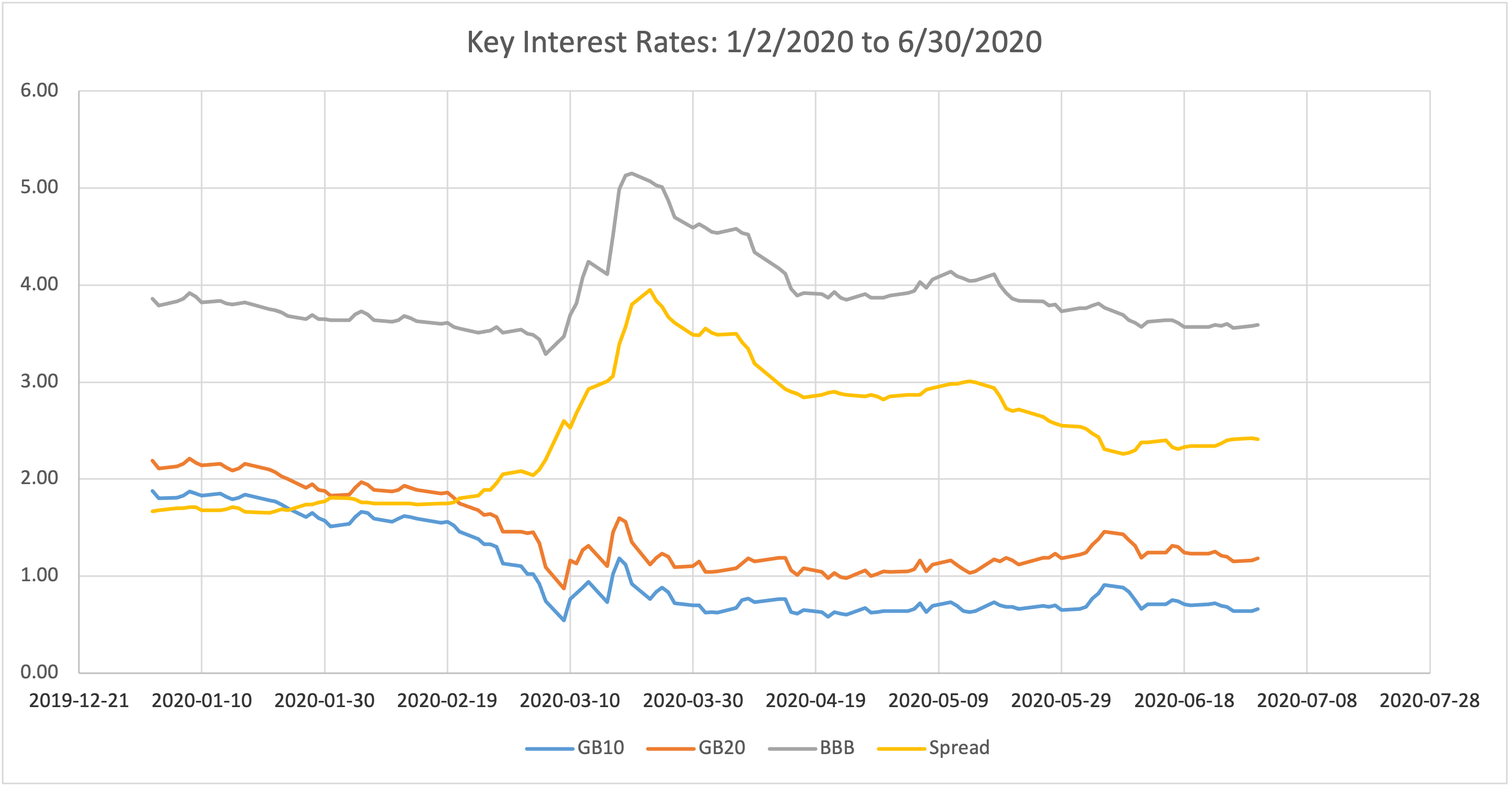

The tsunami reference was to the steep rise in credit spreads following the bankruptcy of Lehman Brothers during the fall of 2008. The following figures update this discussion by providing data on 10-year US government bonds, 20-year US government bonds, and 20-year corporate bonds with credit rating BBB for the period from January 1, 2020 to June 30, 2020. The pandemic financial crisis was only a tidal wave as the spike in credit spreads had moderated by the summer of 2020.

Rossella Brevetti presented a survey of US transfer pricing practitioners on this issue on June 3, 2020.[3] The general tone of these comments were that market interest rates were artificially high, which is an odd statement to make about market rates. While credit spreads at the time were still somewhat elevated, market rates on corporate debt rated BBB or better were not particularly high. One practitioner gave a specific illustration:

“The current volatility in yields could lead tax authorities to later argue that taxpayers took advantage of extraordinary economic circumstances to maximize the interest rate on an intercompany loan,” said Sherif Assef, principal in KPMG’s Washington National Tax Practice based in New York. For instance, a company subject to a 21% tax rate that borrows $100 million at a rate of 5% would get to deduct $5 million per year and reduce its tax liability by just over $1 million. If the interest rate is instead 8%, the deduction grows to $8 million and tax owed is reduced by nearly $1.7 million, Assef said.

The stated reduction in tax liabilities represents only reduced US taxes and ignores the tax effect from intercompany interest income received by the foreign lending affiliate. Let’s consider whether a 5% or 8% interest rate could be defended as arm’s length if the intercompany loan were a 15-year US Dollar-denominated loan issued on June 3, 2020. On that date, the interest rate on 10-year government bonds was only 0.77%, while the interest rate on 20-year government bonds was 1.32%. As such, the credit spread implied by a 5% intercompany interest rate would be approximately 4%.

The interest rate on 20-year corporate bonds rated BBB was 3.79%, so the credit spread for loans with this rating would be approximately 2.5%. The IRS could reasonably argue that the arm’s length interest rate would be only 3.5%. A defense of a 5% interest rate would require a convincing position that the appropriate credit rating should be BB. If the intercompany interest rate were 8%, the implied credit spread would be 7%. A defense of this interest rate would require a convincing position that the appropriate credit rating should be B.

References

Stefano Bognandi, Anne-Carole Chapuis, Andreas Medler and Deyan Mollov, “Transfer Pricing of Loans & Financial Instruments – Latest Development,” Taxand.com.

Harold McClure, “Calculating Credit Spreads During A Pandemic,” Law360.

Rossella Brevetti, “Intercompany Loans Amid Virus Invite Scrutiny by Tax Authorities,” Bloomberg Daily Tax Report.