“Centripetal force is the force by which bodies are drawn from all sides, are impelled, or in any way tend, toward some point as to a center.”

− Isaac Newton, The Principia (Mathematical Principles of Natural Philosophy), University of California Press, 1999 [1687], Definition 5, p. 405.

Center Point of Attraction

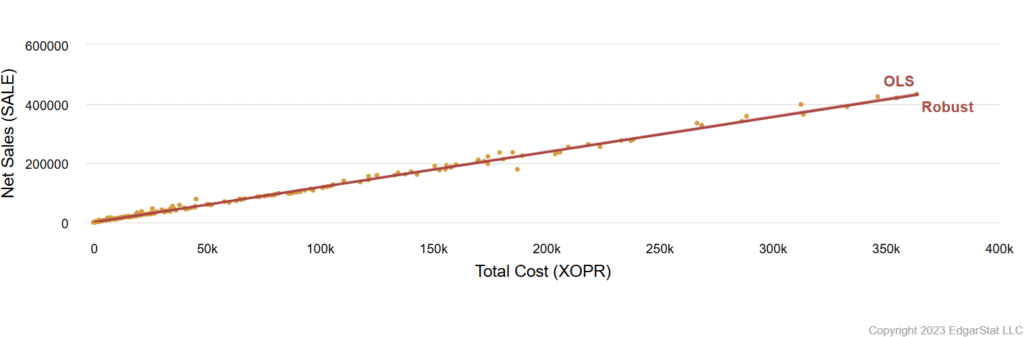

A reliable point of attraction of the operating profit margin can be calculated from the regression of net sales versus total cost.

Operating Profit Model

Let the individual company variables C = Total Cost, S = Net Sales, and P = OIBDP (operating income [profit] before depreciation and amortization). Total Cost = XOPR = (COGS + XSGA). OIBDP may be under-reported to SEC (Securities & Exchange Commission) because impairments can be included in COGS and not combined with depreciation.

Next, consider an (1) accounting and (2) structural operating profit equation:

(1) S = C + P is the accounting equation.

(2) P = α + β S, for 0 < β < 1, is a linear operating profit equation.

(3) S = λ0 + λ1 C is the reduced form regression equation.

(4) λ0 = α / (1 – β) is the intercept.

(5) λ1 = 1 / (1 – β) = 1 + β + β2 + β3 + … is the slope coefficient.

Equation (1) is true by definition and is not subject to dispute. Equation (2) is a testable hypothesis. Equation (3) is the reduced form regression, obtained by inserting equation (2) into (1) and solving for Net Sales. A significant intercept in equation (4) means that the quartiles of the univariate profit margin are invalid. Equation (5) is the operating profit markup (λ1) from which (using indirect least squares (ILS)) the operating profit margin (β) is obtained.

The operating profit margin can also be obtained from equation (5) as β = (λ1 – 1) / λ1.

Since linear equation (2) is a postulated hypothesis, other functional forms (such as a power function) can be tested to determine the most reliable measure of the regression coefficients (see Johnston, 1972, pp. 9, 52).

Statistical Testing of Equation (3)

Take a group of U.S. companies regarded as “big oil” and estimate their individual operating profit markup, considering the financial history available. Using all available data is preferred (to truncate three years of data) because the law of large numbers promises a stable center of attraction and its variance tending to zero as the sample size increases (see Parzen, 1960, p. 371). The following robust (Huber algorithm in Statsmodels) regression results are obtained from estimating equation (3):

- Chevron (GVKEY 2991): Count = 63, λ1 = (1.2269 ± 0.0055) implies β = 22.69%.

- ConocoPhillips (8549): Count = 73, λ1 = (1.1776 ± 0.0021) implies β = 17.76%.

- ExxonMobil (4503): Count = 73, λ1 = (1.1797 ± 0.0042) implies β = 17.97%.

- Marathon Oil (7017): Count = 67, λ1 = (1.1254 ± 0.005) implies β = 12.54%.

- All Four Companies. Count = 276, λ1 = (1.1845 ± 0.0013) implies β = 18.45%.

I use annual data from 1950 to 2022, except for Chevron, whose data series starts in 1960, and Marathon Oil Corp., which has missing (C, S) data from 1982 to 1987.

Takeaways

Scatterplots of net sales (dependent variable) versus total cost (independent variable) show no visual signs of structural shifts of the robust (or ordinary least squares) regression slope coefficients. There are no inflection points for as long as 73 years of individual company history. This stability of the operating profit margin suggests that “big oil” forms an oligopoly industry. Stylized discussions about oil and gas prices determined by supply and demand conditions may be untrue (see Fattouh, 2011).

U.S. big oil has the remarkable capacity to pass−on changes in total cost to customers and thus preserve a stable long-term markup on total cost. The individual long-term operating profit margins gravitate (subject to individual company variations) to β = 18.45% ± 0.13%. These are reliable regression coefficients putting to shame the rote computations of univariate quartiles of operating profit margins (see Mabro, 2006; Mu, 2020 and the more recent book by Imsirovic, 2021 do not mention oligopoly pricing on the index.

Regression Results for U.S. “Big Oil” 1950-2022 (All Four Companies)

References

Bassam Fattouh, “Anatomy of the Crude Oil Pricing System,” Oxford Institute for Energy Studies, WPM 40, January 2011.

Adi Imsirovic, Trading and Price Discovery for Crude Oils, Macmillan, 2021.

Jack Johnston, Econometrics Methods (2nd edition), McGraw-Hill, 1972.

Robert Mabro (Editor), Oil in the 21st Century, Oxford University Press, 2006.

Xiaoyi Mu, The Economics of Oil and Gas, Agenda, 2020.

Emanuel Parzen, Modern Probability Theory and its Applications, John Wiley & Sons, 1960.