In this tutorial we discuss several search strategies that can be carried out in the CUFT Loan Agreements Database (DB) module in EdgarStat. While actual searches will certainly be based on the facts and circumstances of a tested transaction, these examples will cover basic concepts that can serve as a starting point.

The DB contains over 12,000 credit agreements (and amendments where pricing has been amended) with almost 16,000 loan transactions (tranches) from January 2009, as well as extracted terms useful in determining an arm’s length range. The loan transactions are primary corporate loan market activity between third-party lenders and unrelated borrowers. Most are syndicated credit facilities in which several banks (lenders) participate.

Step 1: Determine the Appropriate Time Frame

In the OECD’s Transfer Pricing Guidance on Financial Transactions published in February 2020 (the “Feb. 2020 OECD Guidance”) section B.3.4 Economic Circumstances the execution date of the potentially comparable uncontrolled loan transactions may be a major comparability factor in determining the pricing of an intercompany loan. From ¶ 10.32 Feb. 2020 OECD Guidance:

Macroeconomic trends such as central bank lending rates or interbank reference rates, and financial market events like a credit crisis, can affect prices. In this regard, the precise timing of the issue of a financial instrument in the primary market or the selection of comparable data in the secondary market can therefore be very significant in terms of comparability. For instance, it is not likely that multiple year data on loan issuances will provide useful comparables. The opposite is more likely to be true, i.e., that the closer in timing a comparable loan issuance is to the issuance of the tested transaction, the less the likelihood of different economic factors prevailing, notwithstanding that particular events can cause rapid changes in lending markets.

Depending on the stage of the business and credit cycle, the search period (Tranche Execution Date range) may be as short as a few months to a full year (or more) of historical transactions prior to the execution date of the intercompany loan.

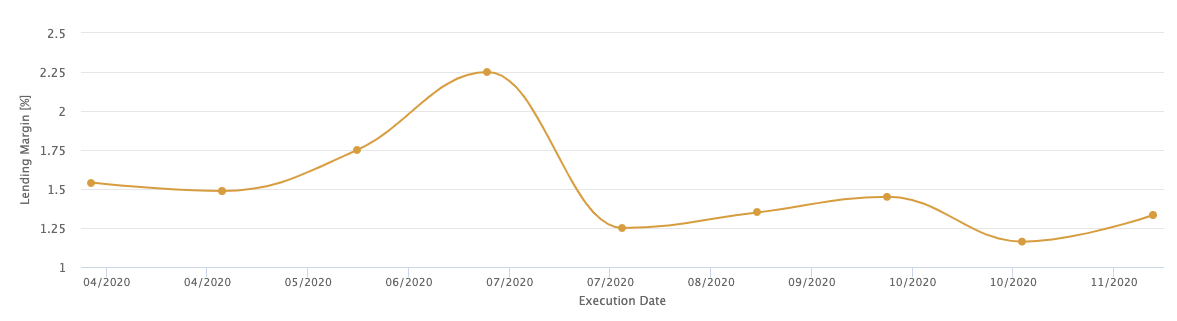

Tip# 1: Use the CUFT DB Time Series chart to visualize data trends over time and whether there is any significant change in lending margins by date (Month/Year) which would suggest a possible change in the credit cycle. In the chart below, we can observe how the market evolved in response to the Pandemic and its different stages:

Step 2: Determine Tested Party Credit Rating

The next major comparability factor to consider in the search process is credit risk comparability. In the DB, credit ratings (if available) for the borrowers (and parent entity, if different than the primary borrower, but may or may not be a guarantor) are included. However, some borrowers are not rated. Transactions with borrowers (or parent guarantors) that are unrated are still useful if your intention is to focus on industry rather than on credit risk.

The DB features an Altman’s Z” Score tool to estimate the bond rating equivalent (BRE) or the implied credit rating of the tested borrower. This tool is used for all US and Foreign, including emerging market countries, public and private industrial, manufacturing and non-manufacturers. (See tutorial on the Altman Z” Score Credit Rating Tool).

Other methods, resources and tools that can be used to estimate the tested party’s credit rating include:

- Moody’s RiskCalc

- S&P Credit Model

- Moody’s Ratings Methodoligies

- Merton’s PD Model

All of the above tools are meant to provide an estimate of credit risk (which may, or may not, be the same result from a credit risk assessment that a bank would perform). By contrast, a credit rating by a credit rating agency is a “through the cycle” assessment of credit risk which may be longer (or shorter) than the term of the intercompany loan being tested.

The credit rating methodology used in publicly available financial tools may differ significantly in certain respects from the credit rating methodologies applied by independent credit rating agencies to determine official credit ratings and the impact of any such differences should be carefully considered. For instance, publicly available tools generally use only a limited sample of quantitative data to determine a credit rating. Official credit ratings published by independent credit rating agencies are derived as a result of far more rigorous analysis that includes quantitative analysis of historic and forecast entity performance as well as detailed qualitative analysis of, for instance, management’s ability to manage the entity, industry specific features and the entity’s market share in its industry (¶ 10.73, Feb. 2020 OECD Guidance).

Any credit risk assessment should take into consideration the impact of the financing. If the loan increases the borrower’s debt (leverage) it is necessary to use the pro forma debt amount in the credit risk assessment. Also, a third-party lender (bank) would consider if credit risk is expected to be stable for the commitment period (tenor) of the tested loan by examining the borrower’s forecasted financials (balance sheet) and earnings (projected income and cashflow statements) over that period (i.e., estimate the forecasted implied credit rating).

After estimating the implied credit rating for the tested borrower and loan the impact, if any, on the implied credit rating due to country risk differences (See tutorial on Country Risk Premium) and for implicit parental support (See tutorial on Notching Stand-alone Implied Credit Rating for Implicit Parental Support) must also be considered.

Step 3: Apply Credit Rating Estimate to Search Criteria

The next step is based on whether the implied rating is in the investment grade category or the non-investment (speculative) grade category.

If, based on a complete credit risk assessment of the tested borrower (and intercompany loan), the estimate is a non-investment grade credit rating, a search for comparables in the same industry or economically similar industries as the tested borrower, independent of the credit rating, may be most appropriate. The range of lending margins for loans to the same non-investment grade rating can be quite broad from industry to industry, as lenders give more weight to industry characteristics in assessing credit risk. For example, if the implied credit rating of the tested borrower is BB/Ba2 a search for comparables are in similar industries (by SIC code or NAICS code) is most appropriate.

Tip #2: With these results you can select potential comparables with BB+/Ba1, BB/Ba2, and BB-/Ba3 (i.e., S&P’s Principal Obligor Credit Rating range and/or Moody’s Principal Obligor Credit Rating range or “not rated” comparables) that have a pricing grid (the Performance Pricing Metric) based on some leverage ratio (which is usually a debt to cash flow type ratio, e.g., Debt to EBITDA).

Tip #3: For comparables that are not rated, if you have access to its financial statements (for instance, through EdgarStat’s company financials database), you can use the Altman Z”- Score model tool in EdgarStat to estimate its implied credit rating.

Tip #4: You may wish to consider doing some financial ratio comparison to select the most appropriate comparables from this search that have credit risk comparability based on the tested party’s ratios compared to the comparables’ ratios.

On the other hand, if the tested party’s implied credit rating estimate is in the investment grade range (i.e., BBB-/Baa3 or higher) the search approach may be less specific about the industry, as lenders price investment grade loans more consistently in relation the borrower’s credit rating and with less regard to the borrower’s industry. Also, most investment grade loans have a pricing grid (or schedule) that is based on the credit rating (or level). In these cases, the lending margin pricing will change as the borrower’s credit rating changes. For example, if the tested party’s credit rating estimate is a BBB/Baa2, then a search for comparables that are rated between BBB-/Baa3 and BBB+/Baa1 (that have pricing grids based on credit rating, i.e., the Performance Pricing Metric) will provide more pricing data points for your analysis. Also see Tip #3 above.

Note: Watch for Annual Fees in the results for investment grade comparables. These are most often referred to as Facility Fees in the credit agreements and are essentially part of the pricing. Add the fee to the lending margin (LM) to get an all-in LM. For marketing or other reasons banks will reduce the LM but increase the facility fee by the same amount.

Step 4: Select Commitment Period (Tenor) Range

The next comparability factor to consider is the loan commitment period (or tenor). Most third-party credit facilities (whether revolvers or term loans) are multi-year commitments, with three to five years being the most common. The lending margin is based on the lenders’ assessment of the credit risk over that commitment period. For example, an intercompany loan with a four-year commitment period would entail a search for third-party loan agreements with tenors between three and five years.

Tip #5: If your tested party loan has a commitment period over five years you will likely need to consider some methodologies to make the comparability adjustment for the difference in the commitment period. (See: tutorial on Making Adjustment for Differences in Loan Commitment Period)

Note: While there are loan transactions with tenors over five years in the DB, these could have other factors (e.g., if the Purpose was to finance an acquisition) that impact the LM and thus should either be excluded from the search or would require comparability adjustments.

Step 5: Consider Additional Comparability Factors

The final step in the search process is to consider other economically relevant characteristics of the tested party loan. In ¶ 10.29, the Feb. 2020 OECD Guidance lists certain loan characteristics that may be comparability factors, as follows:

… those characteristics may include but are not limited to: the amount of the loan; its maturity; the schedule of repayment; the nature or purpose of the loan (trade credit, merger/acquisition, mortgage, etc.); level of seniority and subordination, geographical location of the borrower; currency; collateral provided; presence and quality of any guarantee; and whether the interest rate is fixed or floating.

One of the most common additional factors to consider is Asset Class. The loan asset class indicates the level of priority with respect to the lender’s claim on the assets and cashflows of the borrower. This will have a material impact in determining the level of loan pricing (i.e., lending margin, or LM). As stated in the Feb. 2020 OECD Guidance, the accurate delineation of the intercompany loan is critical – i.e., is the intercompany loan the most senior debt in terms of priority of claim by the related party lender or is it subordinated to a third-party loan?

Generally intercompany loans are senior debt as the tested borrower (usually) has no other debt on its balance sheet. In this case, the pricing would not be materially different for a senior secured loan compared to a senior unsecured loan, as the related party lender has a similar priority claim. In the corporate loan market, the vast majority of investment-grade loans are unsecured and the vast majority of non-investment grade loans are secured.

Note: The type of security provided can also be an important consideration. For example, some loans may be secured by current assets (i.e., cash, receivables and inventory, which are more liquid), while others may be secured by long-term assets (i.e., equipment and other fixed assets, land, buildings, etc., which are less liquid, depreciating and more variable in terms of market value). A description of the security (if provided) is detailed in the Collateral Type field.

Step 6: Determining an Arm’s Length Range

This search process should provide a sufficient sample of potential comparables to perform a full comparability analysis (accept/reject) and make further comparability adjustments to generate a range of arm’s length lending margins.

Note: The lending margin (LM%) is the spread that the lender requires over its estimated cost of funds (COF%). The interest rate is the sum of COF% and LM%:

IRate% = COF% + LM%

To determine a range of arm’s length interest rates, add these lending margins to an appropriate reference rate for the currency of the intercompany loan and the selected interest period (the reference rate is a proxy for the lenders’ almost risk-free cost of funds). According to the financial economic model of Interest Rate Parity Theory, there will be differences in the interest rate depending on the currency denomination of the loan is, even if all other factors, including credit risk profile, are held constant, ceteris paribus (See “Making Currency Adjustments” tutorial) .Most floating rate corporate loans, especially syndicated loans, are priced with reference to 3-month LIBOR (or other Eurocurrency reference rate). LIBOR and other Eurocurrency reference rates are a proxy or estimate for the lender’s cost of funds. Thus, the interest rate is:

IRate% = LIBOR% + LM%

As all the rates are stated on an annualized basis you will need to divide by 360 (for USD) or 365 to get the daily factor, and then multiply this daily factor by the amount of the intercompany loan to calculate the daily interest cost. This interest rate is applicable for the interest period of the reference rate (e.g., 3 Month USD LIBOR).

Note: LIBOR is currently calculated for five currencies (USD, GBP, EUR, CHF and JPY) and for seven tenors in respect of each currency (Overnight/Spot Next, One Week, 1-Month, 2-Months, 3-Months, 6-Months and 12-Months). LIBOR will be phased out for currencies other than USD by the end of 2021 and by June 2023 for USD.

To determine the interest rate for fixed-rate loans, the lending margin is added to the interest rate “swap rate” for the fixed-rate period and currency of the loan. In a swap transaction, which involves an exchange of a floating interest rate (for LIBOR currencies, this would be 3-Month LIBOR) with a fixed rate, the receiver of the floating rate would be able to offset the floating rate portion of its borrowing costs (based on 3-Month LIBOR) and would be left with the fixed interest rate calculated as the LM plus the swap rate. (Resource: Federal Reserve Economic Data, example ICE Swap Rates for U.S. Dollar, 10 Year Tenor ICE).

Concluding Remarks

There are other special circumstances search strategies that are not covered in this tutorial. For example, if searches for different Asset Classes, e.g., subordinated or junior debt type comparables require many other considerations, including the quantification of the comparability adjustment for the degree of subordination.

Another example is to search by Tranche Type (which is either Revolver or Term), as lending margins can be, but are not always, higher for a term loan compared to a revolver for the same borrower in the same credit agreement and for the same commitment period. You would also want to eliminate financing transactions that are duplicate comparables (for instance, when a borrower has the same lending margin for its five-year revolver and five-year term loan).

Sometimes the Tranche Purpose can also be a material comparability factor. Usually this is when the loan purpose is to fund an acquisition which could have a significant impact on the borrower’s credit risk profile.

References

Transfer Pricing Guidance on Financial Transactions, OECD.org, February 10, 2020.