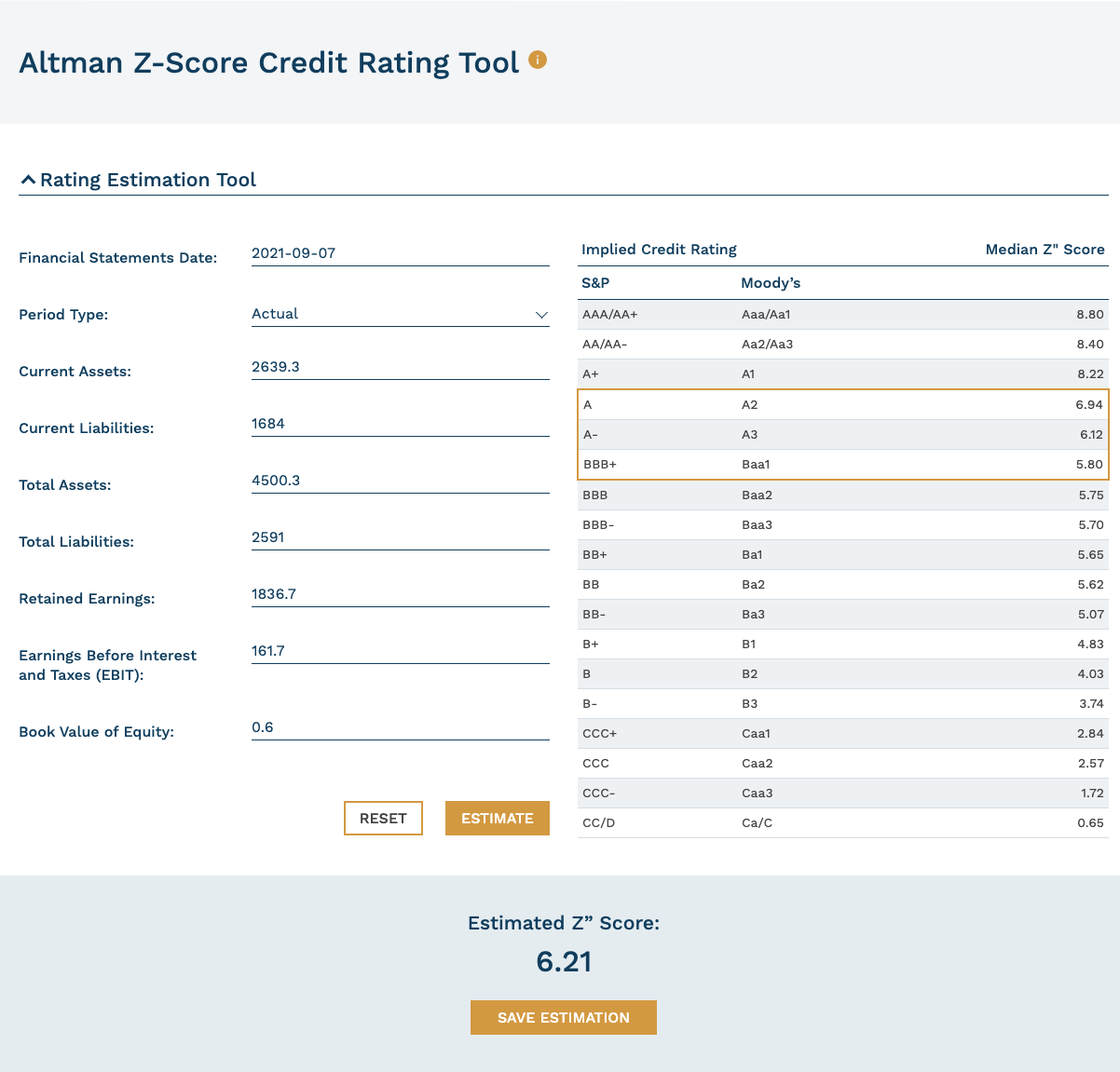

In this tutorial we introduce you to a tool for estimating the implied credit rating of your tested borrower using the Altman Z”-Score Model.

The Z Score family of models were developed by Dr. Edward I. Altman who is the Max L. Heine Professor of Finance at the NYU Stern School of Business and Director of the NYU Salomon Center’s Credit and Debt Markets Program. The original Z-Score model was developed in 1968 with revisions made in 1995 (Z’-Score and Z”-Score). These models cover industrial publicly-held manufacturing firms (Z-Score), industrial privately-held manufacturing firms (Z’-Score), and non-manufacturing industrial-firms in the U.S. and abroad, including emerging market firms both public and private (Z”-Score). Note: With the addition of the constant (3.25) to the Z”-Score model Altman accounts for Emerging Markets.

The formula is as follows:

Altman Z”-Score = 3.25 + (6.56 x X1) + (3.26 x X2) + (6.72 x X3) + (1.05 x X4)

Where

- X1 = (Current Assets – Current Liabilities) / Total Assets

- X2 = Retained Earnings / Total Assets

- X3 = Earnings Before Interest and Taxes / Total Assets

- X4 = Book Value of Shareholder’s Equity / Total Liabilities

Step 1: Gather Financial Data on the Tested Borrower

This should include the most current annual financial statements (i.e., balance sheet and income statement), interim financials, proforma financials, which show the impact of the new amount of the intercompany loan, and financial forecasts for the same period as the term on the intercompany loan, if available. As inputs into the model, you will need the following financial data to calculate the Z”-Score and the mapped implied credit rating:

- Current assets

- Current liabilities

- Total assets, including intangible assets (if available)

- Retained earnings, sometimes called earned surplus (from the balance sheet)

- Earnings before interest and taxes (EBIT) (last 12 months)

- Book value of shareholders equity

- Total liabilities (all liabilities, not just debt)

Step 2: Input, Calculate & Save

Fill in the Credit Estimation Tool fields with data from the actual (last annual) financials. Click “Estimate” and the model will calculate the Z”-Score using the formula and show the implied credit rating (one or more credit ratings will be highlighted) mapped to the Z”-Score. Click “Save Estimation,” so that you can recall in the future.

Step 3: Repeat for Proforma and/or Financial Forecast

Repeat using the proforma financials, which show the impact of the intercompany loan on the actual financials. If the intercompany loan is for purchase of equipment, then both the additional debt and fixed assets will need to be adjusted in the actual financials on a proforma basis. Run the estimation and save.

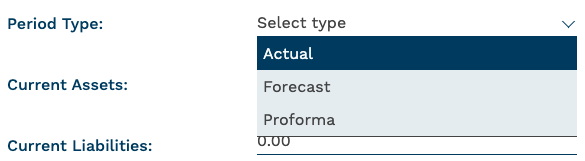

To document the period type, you can select from the drop down.

If available, repeat once again with data from the financial forecast. All inputs into the model would need to be forecasted on an annual basis. Depending on the term of the loan (years), this will generate an estimation for each forecasted year. Save each estimation. NOTE: It is recommended to do this for the same period as the commitment period of the intercompany loan.

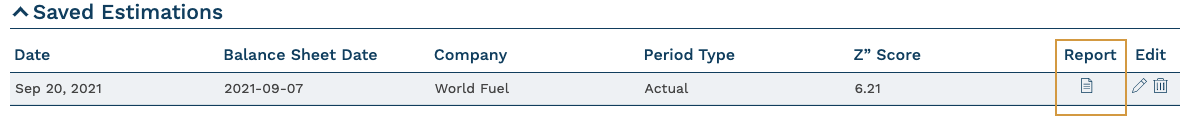

Step 4: Document

After you’ve saved your estimates, you can find a list of your saved estimations below the Median Z”-Score. Click on the icon in the Report column download a credit estimation report to review the estimations internally and include as an exhibit to your transfer pricing documentation.

Step 5: Review All Estimations

Determine the best implied credit rating (or range) to use in your search of the CUFT Database. (See “Tutorial: Benchmarking with the CUFT Loan Agreements Database EdgarStat”).

Step 6: Other Considerations

With regard to the final estimated implied credit rating, you may want to also consider:

- The sovereign rating of the country in which the tested borrower is incorporated and operating: and

- impact of implicit parental support based on the Parent/Group credit rating (e.g., Moody’s Corporate Family Rating, CFR).

NOTE: As a further comparability analysis step you could consider running the Z”-Score model to estimate the implied credit ratings for each of the borrowers of the selected comparable uncontrolled loan transactions from your search in the CUFT Database.

DISCLAIMER: The use of any publicly available financial tool or model, including the Altman Z”-Score, to estimate the implied credit rating for the tested borrower should be considered with reference to the OECD’s Feb2020 “Transfer Pricing Guidance on Financial Transactions“ (pars 10.72-10.75).

References

John Hollas, “Tutorial: Benchmarking with the CUFT Loan Agreements Database in EdgarStat,” EdgarStat Blog, September 15, 2021.