A power function has the form:

(1) Y = Xβ

where the slope parameter β is determined from data comparable to the tested party. Y is the dependent variable and X is the independent (explanatory or predictor) variable.

The contrived linear function: Operating Profits = βRevenue, with the forced zero intercept specified in the U.S. and OECD guidelines, and the quadratic and cubic functions are power functions. Other power functions include the reciprocal and square-root functions.

Typical power functions in economics include:

- Linear: Y = β X, like the U.S. and OECD profit indicators.

- Quadratic: Y = X2, where β = 2.

- Cubic: Y = X3, where β = 3.

- Reciprocal: Y = 1 / X, where β = −1.

- Squared root: Y = √ X = X1/2, where β = 1/2.

Here, we examine a power function that is prevalent in economics:

(2) Y = α Xβ

and take the first derivative of (2) to obtain the slope coefficient:

(3) d Y / d X = β α Xβ – 1

Slope = β α (Xβ / X) = β (Y / X)

Except for the special case in which α = β = 1, we can use the double-logarithms regression to estimate the slope of the power equation (2):

(4) LN(Y) = LN(α) + β LN(X)

Now, we consider the best regression fit among two rival operating profit functions using actual company-level annual data:

(5) Y = α + β X,

versus the power equation (2) or its regression version (4).

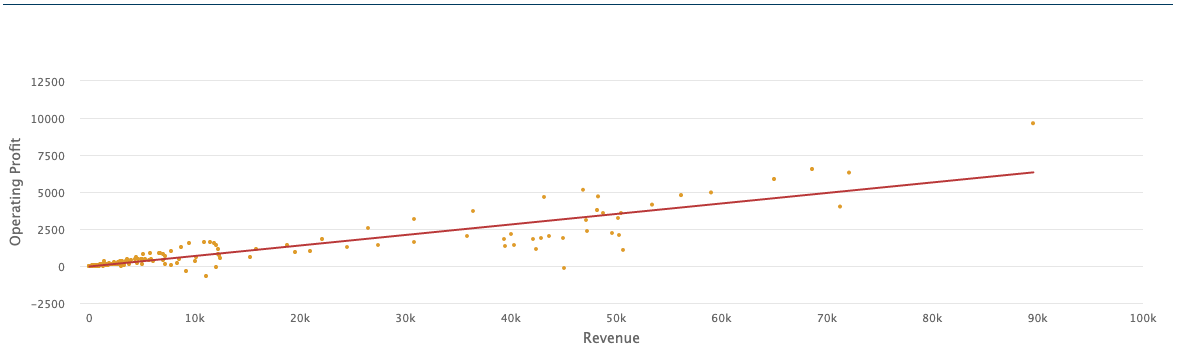

Chart 1 contains the linear regression: Y = 0.071 X, with the Newey-West t-statistics of the slope = 7.8158 and the R2 = 0.8032. The alpha-intercept is not significant, so we don’t report it.

Chart 1: Linear Regression

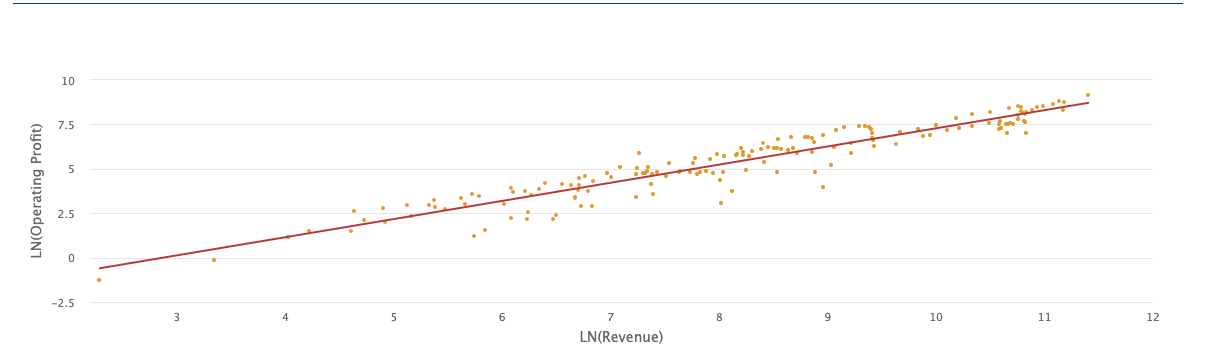

Chart 2 contains a more reliable double-logarithms regression (4): LN(Y) = 1.0219 LN(X) − 2.938, with the Newey-West corrected t-statistics of the intercept = − 8.6162, the t-statistics of the slope coefficient = 26.035, and the R2 = 0.9043. Each regression contains 167 annual paired X and Y observations.

Chart 2: Double-Logrithms Regression

As a takeaway, we must examine the comparable company data using bivariate scatterplots instead of assuming the special (contrived) linear equation without an intercept:

(6) Y = β X,

where the intercept of linear function (6) is forced to be α = 0.

The regression results above were computed online in EdgarStat using the historical pairs of X = Revenue (REVT) and Y = Operating Profits (OIADP) of five U.S. retailers :

- 73119 Bed, Bath & Beyond (BBBY), 1990-2021

- 27050 Best Buy Inc. (BBY), 1983-2021

- 107748 Conn’s Inc. (CONN), 2000-2021

- 5067 Lowe’s Companies Inc. (LOW), 1984-2021

- 36090 Williams Sonoma Inc. (WSM), 1986-2021