Profit Benchmark Report

Subscribe to our Profit Benchmark Report for data-driven transfer pricing analysis. Enter your SIC code, target country, profit indicator, and audit year range to receive a comprehensive, tailored report.

FIND OUT MORE

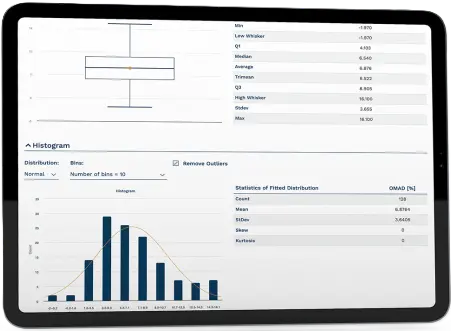

Perform Statistical Analysis

Calculate interquartile ranges, apply asset-based adjustments, and run regression analysis to derive reliable profit indicators. Benchmark recurring intercompany transactions with our interactive databases and tools.

Software Features

Adjustments for Comparability Factors

Dynamic Accept/Reject Matrix for Comparability Analysis

Access to 10-K Filings (US-listed companies)

Online Calculations of Interquartile Range

Regression Analysis of Comparable Profits Indicators

Exploratory data analysis tools for tests of reasonableness

Leadership Team

Ednaldo Silva

Managing Director

Marcos Valadão

Director

Julia Vasconcellos

Director

Joshua Jones

Director

Joanna Jeziorek

Manager

Bartosz Niejadlik

Director

Transfer Pricing Analysis Blog

Explore transfer pricing topics and profit-based methods, including TNMM (CPM in the U.S.) and other enterprise-level approaches.

Producer Price Inflation

Measurements and Uncertainties in Transfer Pricing

Profit Rate Dynamics via ARDL: A Minimal Specification

Tutorial: Applying Basic Calculus to Everyday Economic Discourse

GDP Growth by Debt Acceleration

U.S. Operating Profit Markup, 1950-2022

Theory of Profit Markup in Transfer Pricing

Operating Profit Margin is More Reliable than Return on Assets

Operating Profit Margin of U.S. Big Oil

Contact Us

To schedule an online demonstration, please fill out the contact form.